All organizations need to invest to grow. The amount available for investment is, however, constrained by their funding capacity. A critical control mechanism adopted by management is the budget. This is the amount of money endorsed by stakeholders to be spent on investment, in line with financing and business strategy. Efficient and effective control of Capital Expenditure is achieved by explicitly allocating budget to authorized initiatives, and monitoring (and limiting) the actual spend accordingly. For organizations that run SAP as their digital core, the Investment Management module provides a suite of functionality to support the allocation of funds to authorized investment initiatives. In this article we outline the SAP functionality, design considerations, constraints, and supporting solutions to help you leverage this functionality to effectively prioritize your investments and maximize your return.

SAP Investment Program Functionality Overview

The capabilities of SAP Investment Management for defining and monitoring the Investment Budget are:

1. Investment Programs

An Investment Program in SAP is the highest-level structure for budget administration. All budget items (positions) are assigned to an investment program. The investment program is for a specified fiscal year and reporting currency. All legal entities under a single local management structure (Controlling Area) can be combined in a single investment program. In a large group, spanning multiple jurisdictions, currencies, and even fiscal periods, it is often necessary and more convenient to maintain multiple investment programs. Reporting is done by Investment Program.

2. Investment Program Positions

Investment Program Positions are budget items within an Investment Program. Hierarchical budget structures can be defined by linking positions to each other. Individual investment measures (eg Projects or Internal Orders) can only be linked to the lowest level positions in the structures. SAP provides functionality for adding positions into the program structure, and ‘rolling-up’ budget from the lowest level budget positions to the higher-level hierarchy nodes. Key attributes of an Investment Program Position include organization assignment (company and plant), investment reason and asset class.

3. Budgets vs Plans

Within SAP, two sets of control values can be maintained: Plans & Budgets. From an SAP terminology perspective, plans are more like ‘soft’ targets or forecasts and can be exceeded. Budgets, by contrast, are ‘hard’ limits, and procurement in excess of the allocated budget, on the investment measure, is generally prevented. Plans can be structured into multiple versions (based on periodic reforecasts, for example), whereas there is only a single version of the budget for an approval year, although a budget may encompass spending in both the current as well as prior and future years.

4. Original Budget, Supplements & Returns

Adjustments to the original ‘approved’ budget on an investment program position are managed through supplements (when the budget is increased) or returns (when the budget is decreased).

5. Integration with Appropriation Requests

Within standard Investment Management set-up, budget allocation ‘wish-lists’ are submitted using Appropriation Requests. Appropriation Requests specify the required capital and overhead investment required to generate an anticipated return. If Appropriation Requests are approved and linked to an Investment Program position, the planned cost of the Appropriation Request can update the planned cost on a position through a bulk update process. The planned costs on an Investment Program can be copied to original budget values. Note that Appropriation Requests do not have a ‘budget’ and ‘budget’ cannot be transferred directly from or to an Appropriation Request. Budget can, however, be distributed from Investment Program positions to investment measures created from or linked to an Appropriation Request.

6. Distributions

The primary method of budgetary control in SAP Investment Management is to ‘distribute’ budget from the Investment Program to an investment measure (Project or Internal Order). Once distributed, the budget is no longer available for distribution. This mechanism ensures that the original budget cannot be exceeded. If the budget is no longer required on the measure, it can be returned to the program and reallocated to another project. Note that an investment measure can only be assigned to a single program position.

SAP Investment Program Design Considerations

When setting up SAP Investment Management, the following should be carefully considered:

1. SAP Investment Program

The number of Investment Programs to be used in an organization should generally be based on the responsibility for their approval and monitoring, typically by ‘controlling area’ – grouping of related entities under one management currency, fiscal year, and set of cost controlling units. It may be useful to further breakdown the Investment Programs if the programs within a ‘controlling’ area are managed independently. For example, if the production and environmental health and safety budgets are independently managed, it would make sense to create two separate Investment Programs. Additionally, if budgeting is performed at a more granular level, separate programs may be convenient to facilitate the ease of selection and administration of budget positions. For example, if there are many IT projects budgeted, it may be easier to manage them in a separate program. From a central controlling perspective two programs with the same base currency and fiscal year, can easily be aggregated together for overall reporting purposes.

2. Approval Year

Investment Programs are defined by approval year. Typically, this is the primary fiscal year for which the budget is prepared, not the year of ‘approval’, even if this occurs before the subject fiscal year. For example, the budget approved in 2021 for fiscal year 2022, should be captured in the 2022 Approval Year Program. Using the approval year aligned to the fiscal year, makes it much simpler for end users during the control year.

3. Currency

A separate Investment Program is required for each reporting currency. In a large group, with multiple local currencies, all entities can be aggregated into a single Investment Program if they have the same fiscal year and the same controlling area currency.

4. Hierarchy Structure

An hierarchical budget structure facilitates executive analysis in standard reporting by enabling expansion to more detailed levels and items only as required. These hierarchies can be structured based on your organizational structure, asset categories, investment scale, priority, or any other meaningful analysis framework. Programs can be rolled over from one year to the next, and this hierarchy can thus become quite entrenched. However, as various executives over time may prefer different grouping and drill-down, it is recommended to keep the embedded hierarchy relatively flat, and leverage reporting tools to provide structured and graphical analysis capability.

5. Program Position Granularity

Investment Program Positions can hold approved budget for individual initiatives as well as represent funding ‘pools’ (for a category of investments eg Environmental, Health and Safety or for an organization unit eg Plant). Naturally, the more granular the funding budget, the tighter the budgetary control. It is common for actual allocation of investment funding to vary considerable from the ‘annual business plan’, and with standard SAP, it is not easy to pick alternative ‘compensating’ positions to fund those more pressing initiatives. Consequently, many organizations choose to define their program positions at a higher, more aggregated level. However, with a more flexible Capital Expenditure Request form that allows for selection of primary funding postings (if applicable) as well as compensating positions, and automates the budget ‘shifts’ automatically, it is possible to define the budget at the ‘true’ level: as ‘pool’ positions where the details are not predetermined, and a specific project initiative level where the funds are pre-allocated (which the provision of funds may ultimately be re-directed).

6. Planning Horizon

An Investment Program can encompass a multi-year planning horizon, typically including the prior year (for pre-approvals), and future years, where budget availability is managed on a budget year basis. For example, an approval year budget may allocate 70% to the corresponding fiscal year, 5% to pre-approvals, and the balance over the following 3 years as illustrated below:

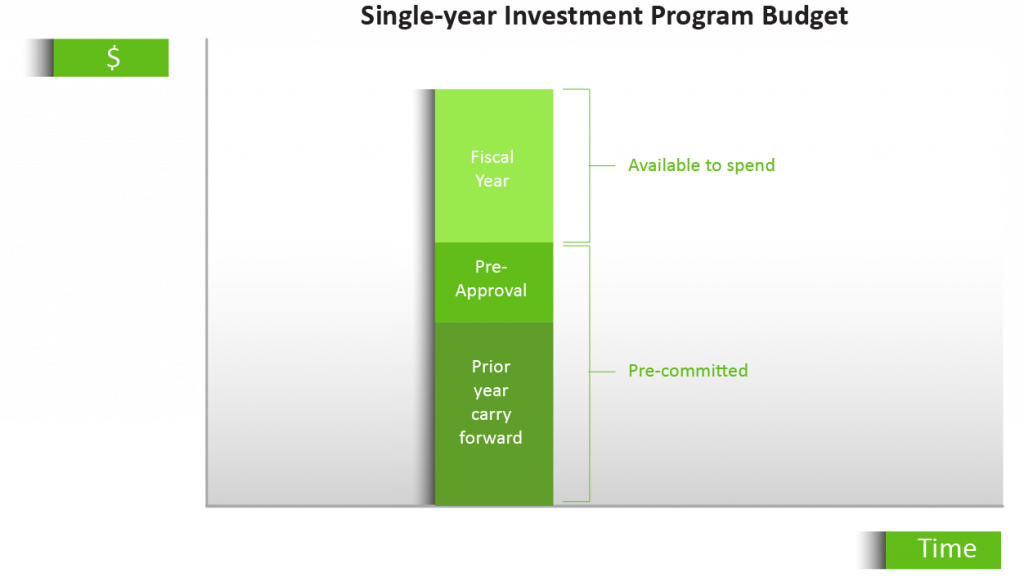

A multi-year planning horizon enables project initiatives to be fully funded in the approval year for the duration of the planned expenditure. In practice, few organizations have the maturity or tools to monitor and control multi-year (and therefore overlapping) Investment Programs. Typically, organizations have a top-down annual Capital Expenditure budget number that is available for distribution to priority initiatives. Carry-forward projects from prior periods simply consume some of this available funding, reducing the amount of funding available for new initiatives in the fiscal year. This is illustrated below:

The decision on whether to manage multi-year or single year program budgets should be aligned with the funding constraints imposed on the organization and not by system usability. With IQX CAPEX, both forms of planning horizon are easy to use and effectively accommodated.

7. Total or Capital

Budget Appropriation Requests comprise both capital and overhead (non-capitalized) costs. For example, a new machine investment may incur up-front market research and selection costs which are not capitalizable. The same machine may impose a long-term consumable and maintenance running costs. When planning to invest in such a machine, should the budget in the Investment Program accommodate both the capital and overhead expenditure, or simply the capital components? If a single investment measure is budgeted to accommodate both capital and overhead costs, how are these respective cost categories differentiated?

SAP supports the total-cost funding model, with the option to define settlement rules by time or percentage to either a fixed asset or a cost centre. Separate general ledger accounts, as specified in the allocation structure, are used to differentiate capital costs from overhead cost components for asset capitalization. Unfortunately, within SAP budget availability, control cannot be limited to specific cost categories. Therefore, if both Capital and Overhead Costs related to a project initiative are to be subject to budgetary control, a single investment measure can be used, and the Investment Program should provide for both. However, most organizations will plan overhead costs in their cost centres or internal orders, and only capital costs are subjected to strict budget control. In this normal case, whilst the total project cost will be considered for approval, only the capital investment measure will be budgeted, and therefore it is only the capital component of projects which needs to be included in the Investment Program.

8. Depreciation Simulation

Once planned investment initiatives are completed and capitalized, annual depreciation will start to be incurred. SAP provides powerful functionality for calculating this planned depreciation, for inclusion in the organization’s overall financial planning. To automate this planned depreciation calculation, Investment Program Positions will need to be assigned to an Asset Class and have a planned Capitalization Date assigned. This functionality is often not effectively employed where manual maintenance of these attributes is required. However, with an easier and more efficient Investment Program maintenance application, as provided by IQX CAPEX, maintaining this data is efficient and it is practical to take advantage of depreciation simulations.

9. Status Managements

Investment Program Positions can be effectively status managed within SAP. By setting and considering relevant statuses, the gradual release of annual budget can be enforced, and the reconciliation of the overall budget status effectively monitored. This valuable functionality is often not used, simply because of usability considerations, that can be easily addressed with a SAP Fiori application, such as IQX CAPEX.

10. Investment Reasons

All investment is incurred for a reason. For example, essential replacement of existing assets, cost-saving, growth, or regulatory compliance. Defining and assigning meaningful investment reasons to all Investment Program Positions, enables budget item selection within an expenditure request, drives the approval workflow, and enables rich program analysis. As these investment reasons flow through to the investment measures, it is important to structure these reasons carefully for long-term effectiveness of reporting.

11. Asset Class or Category

Most budgeted Capital Expenditure is for a definable asset type, for example buildings, machinery or software. Often, however, at the planning stage, the final asset class may not yet be known, and a particular budgeted initiative may comprise a combination of asset types (eg hardware and software). For this reason, higher level ‘Asset Categories’ may provide an easier to use and more flexible framework. For example, ‘Information Technology’ may be a more useful asset category in the budgeting phase, where the exact breakdown is indeterminate at this early stage. These ‘Asset Categories’ should still be assigned an indicative account assignment and ‘useful-life’ for approximate depreciation simulation calculations.

12. User Fields

In SAP, a limited number of user fields are available for further classifying and analyzing an Investment Program. Because of their limited number and type, care should be taken in their adoption, to deliver long-term value. For example, IQX CAPEX makes use of User Field 11 (a Boolean field) to identify pool positions, and adjust the user-experience in the Capital Expenditure Requests accordingly.

Limitations of SAP Investment Management

1. Budget Approval

There is no standard functionality in SAP to prepare, workflow for approval and automatically create an Investment Program. With IQX CAPEX, an Investment Program proposal can be created manually in a user-friendly Fiori app, from an Excel upload, or from Appropriation Requests. Following a collaboration, review and approval process, the Investment Program is automatically created with all approved positions and annual budget.

2. Monthly Planning and Forecasting

The expected Capital Expenditure per month cannot be maintained in SAP Program Positions. This is a key requirement for many organizations that carefully manage their funding and treasury operations. To address this gap using standard SAP functionality, IQX CAPEX automatically creates a linked investment measure up-front for each program position, and the cashflow per month is planned on these measures. User statuses are applied to the investment measure to prevent procurement from occurring on these ‘planned’ measures. Once authorization for expenditure is granted on the projects, budget is distributed to them and the measures are released to allow procurement activities to commence.

3. Useability

A key constraint to the adoption of SAP Investment Management has always been the user-experience. Where it has been deployed (because it is difficult to track and monitor changes to an Investment Program, and as simultaneous access by multiple users is not possible), access is typically constrained to a very small group of central administrators. Consequently, the exchange of budget information between responsible business units and this central controlling team is typically enabled via spreadsheets and side-systems leading to loss of integrity, delays and inefficiencies. A key objective of the IQX CAPEX solution is to provide a fully integrated and seamless user experience for initiators, approvers and administrators to accelerate and control the end-to-end process.

4. Distributions, Shifts & Transfers

The is no standard SAP functionality to request, approve and execute a budget distribution to an investment measure in a controlled fashion. With IQX CAPEX, the Capital Expenditure Request process provides the Fiori app user-experience, approval workflow and back-end SAP process automation. Budget transfers between positions are automated as supplements/returns, and the total approved budget is then distributed from the primary program position to the investment measure that is itself automatically created. In addition to budget distributions, the planned monthly expenditure is updated as a planning version on the measure, and the measure status is updated.

5. Prioritization

SAP ERP provides no standard functionality to conduct investment portfolio planning: to be able to sort and filter budget Appropriation Requests to optimize a program based on prioritization (as opposed to discrete request approval). In practice, most organization are faced with a surplus of investment demand, of many viable initiatives. The key management challenge is prioritization of these requests given funding, scheduling and resource constraints. IQX CAPEX provides the interactive tools, to enable more dynamic budget item prioritization.

6. Risk and Sensitivity Analysis

Neither the SAP investment Program Positions, nor the underlying Appropriation Requests, support sensitivity analysis. Projected revenues or savings from an investment are based on key input assumptions, that are subject to a degree of variability. Simply basing initiative selection on ‘most-likely’ outcomes, without fully considering the range of potential outcomes that a multi-variate simulation can indicate, may result in a sub-optimal portfolio, with a higher-risk project over-represented. IQX CAPEX addresses this sensitivity analysis requirement.

7. Strategic Alignment

There is no standard SAP field or structure to explicitly align Investment Program Positions to strategic initiatives. With IQX CAPEX, all budget Appropriation Requests are clearly aligned with strategic outcome to ensure that an organizations’ most imperative projects are prioritized.

8. Annual Budgeting Validity

SAP standard functionality is aligned to a fiscal year concept of annual budgets and reconciliations. In an ever-accelerating business environment, this ‘annual planning’ process is increasing being replaced with ‘rolling’ forecasts and more agile Investment Programs. With a focus on efficient end-user engagement and extensive automation, IQX CAPEX provides a much more flexible framework to support accelerated decision-making cycles.

9. Analytics

Capital Budgeting is a key financial control. To be effective, it relies on effective executive information and analysis. The key requirements of reporting effectiveness are accessibility, informativeness and reliability. IQX CAPEX executive analytics delivered through Fiori delivers on all counts:

- It is accessible on any device,

- Graphical presentation makes useful interpretation easier; and

- Data is all sourced directly and securely from SAP for absolute integrity.

Annual Business Fiori Application for CAPEX Budgets

SAP Investment Management (SAP IM) provides an effective structure and set of functionalities for managing your Investment Budget. As always with SAP, the solution offers significant flexibility to meet the needs of individual organizations. Setting the system up correctly is essential to achieving the required degree of financial governance and control. Care must be taken to understand the limitations of SAP IM and to provide effective compensating functionality to deliver a complete business solution.

IQX CAPEX, a ready to run suite of SAP Fiori applications, includes an Annual Business App that allows customers to manage their CAPEX budgets and forecasts at a more granular level for more effective control and to ensure a higher return on your portfolio of capital investments.

Related Posts

If you enjoyed reading this, then please explore our other articles below: