Overview of the Capital Expenditure Budget

Most organizations prepare an annual capital expenditure budget that is approved by the management board on behalf of all stakeholders. Most senior managers will even know the exact number, as the ‘business as usual’ budget remains relatively consistent year on year to effectively replace and gradually expand the capital base whilst driving operating efficiencies. However, when probed as to what this number represents, a variety of responses follow: “this is what we can commit to”, “this is what we can incur”, “this is what we can spend”, or “this is what we will capitalize this year”. This may end up being the same number, but it is important to understand the timing differences involved to ensure that report and expectations are appropriately aligned.

This post will explore these timing differences, the functionality of SAP to monitor these various flows, and the opportunity to improve reporting to all stakeholders.

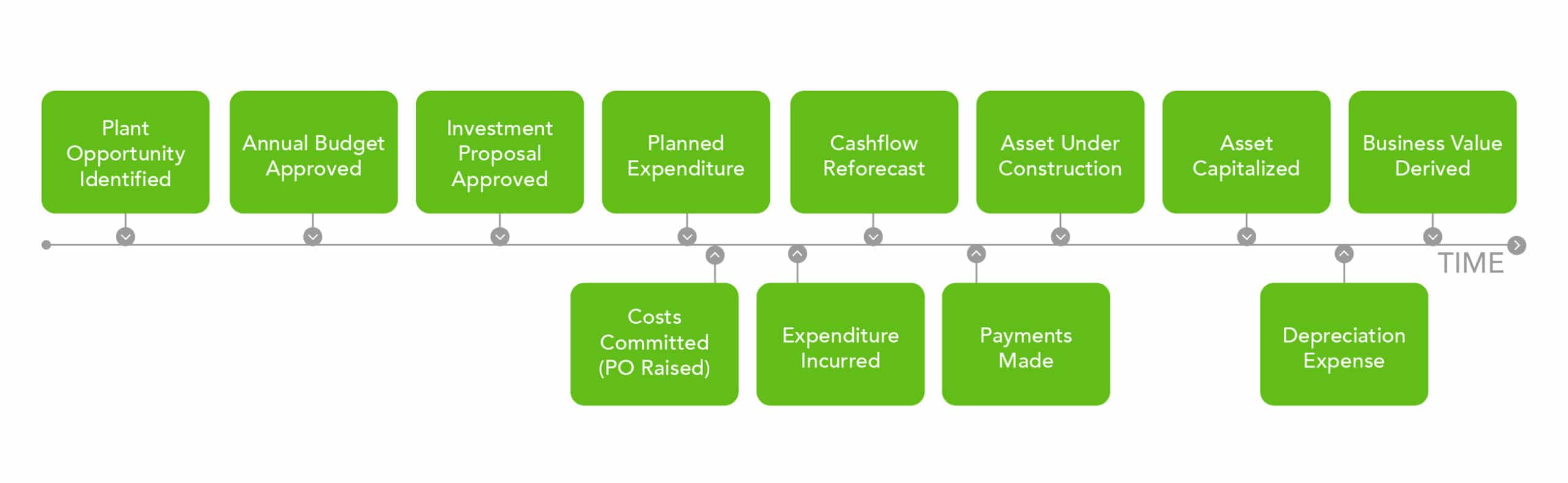

The following diagram illustrates the timing of different events in the capital expenditure budget process, affecting stakeholders in CAPEX management:

SAP Capital Expenditure Budget and Cashflow Forecasting Concepts

Appropriation Requests

The timing of investment cashflows is first submitted in a budget appropriation request. Initiators are able to specify the expected timing of requested expenditure by year for multi-year projects. This project expenditure profile will form the basis of the capital expenditure budget distribution to the investment measure (project or internal order). At the appropriation request stage, these timing are often indicative only, and differences in timing between order, receipt and payment may not affect the overall investment decision. However, technically, these annual amounts represent the planned incurred cost per year.

Commitments

Commitments are raised when a purchase order is placed with a supplier. For long lead-time purchases, there may be many months between raising a purchase order and receiving the ordered goods and services. The commitment is recognized within SAP on the date that the order is placed for the delivery dates specified. Note that this may not be legally correct depending on the contractual terms. Depending on the approval and release status of the investment measure, SAP may not allow commitments to be raised at all. If the measure is released and budgeted, however, and if budget availability control is activated (which it normally is for capital projects), then the value of the commitment is limited to the overall or annual amount budgeted. With overall budgeting and availability control, the timing of receipt is not applicable. However, where annual budgeting control is activated, SAP will ensure that the commitment amount cannot exceed budget in the period that the goods or services are expected to be received. This expected date of receipt is provided by the schedule lines on the purchase order. This gives rise to the first practical challenge: if a project is planned to be completed this year, and is budgeted to be completed this year, and a purchase order is raised this year, but the timing shifts and the goods and services are scheduled to only arrive next year, then standard SAP will prevent the order from being raised if annual capital expenditure budget availability checking is active!

Incurred Costs

Capital expenditure is incurred when the actual costs are posted to the investment measure (Project Work Breakdown Structure or Internal Order). For external supplies, the timing of this is defined in the purchase order: with three-way matching enabled, this is on receipt of the goods or services, irrespective of the timing of the invoice. With only two-way matching, this is the posting date of the supplier invoice. Internal re-charges are incurred based on the posting date of the cost distribution (from timesheets, for example) or financial journal posting.

Allotted or Assigned Expenditure

In SAP reports the total of both incurred and committed costs is referred to as either allotted or assigned expenditure.

Planned (Forecast) Costs

Within SAP, future costs are captured in a planning version. The planned costs are typically combined with actual costs to date to provide a total planned cost to complete. There is, however, no internal reconciliation between committed and forecast expenditure, and inaccuracies in the maintenance of forecast expenditure. For example, by allowing forecasts lower than actual total commitments, can impact the reliability of reporting.

Settlements and Asset Under Construction

Whilst capital costs are typically account assigned to a cost element (general ledger expense account), the costs do not normally appear in the income statements, as they are ‘settled’ first to an asset under construction (work in progress) during the project delivery phase and finally to a resulting fixed asset. Consequently, the ‘cost’ of projects is not directly visible in the trial balance, as the balance on the fixed asset procurement cost element typically has a nil balance after settlement. To provide further financial transparency, a separate summary ‘settlement’ account can be used ‘credit’ the actual cost posting on an investment measure. This allows both the original nature of expenditure (e.g. goods vs services) and the gross project expenditure to be distinguished from the amounts credited monthly to capital work in progress.

Payments

Depending on the payment terms negotiated with suppliers, actual payment for goods may be one to three months after actual receipt of goods and services. Occasionally, deposits and milestone payments to suppliers may be triggered prior to receipt. Consequently, the actual cashflow to suppliers is only indirectly related to the timing of commitment and actual receipts. Within SAP, the treasury and cash management module of SAP provides tracking of the actual cash flows on supplier invoices. Therefore, whilst for convenience project expenditure is often referred to as ‘cashflow’, in practice this is really the date of incurred expenditure. Actual vendor payments and liquidity management is the focus of the treasury department and not normally the responsibility of project managers.

Capitalization

The effective capitalization date of fixed assets resulting from a capital project is important as it is this date that will form the basis for depreciation calculations. To assist with planning depreciation costs, the planned capitalization of fixed asset projects can be specified as early as the appropriation request (or investment program position if detailed project-level programs are maintained) and on the investment measure itself. The asset capitalization date is finally determined on project closure and should be set on a timely basis to maximise tax benefits.

Opportunities

The end-to-end capital expenditure budgeting process should be managed within your SAP system to take advantage of the rich functionality provided. The foundation provided by SAP can, however, be enhanced with an improved user-experience, process workflow management and transaction orchestration as outlined below:

Intuitive User-Experience

The are many participants engaged in the capital expenditure process with different perspectives. The timing of the budget availability may mean different things to these various stakeholders. For the plant manager, it is their expectation as to when the asset will be replaced. For procurement, when the order will be placed. For finance, when the funding needs to be available. To ensure consistency of interpretation, the user interface to the capex process should clearly define the budget timing definitions with supplementary guidance and consistent terminology. Avoid terms such as ‘cashflow forecast’ or ‘annual commitments’ in favour of ‘expenditure per year’.

Combining Budgeting and Planning

Technically within SAP budgeting and planning are independent: budgets impose procurement limits, planning aligns expectations. Other than limited reports, there are no standard budget or plan update transactions that combine these two sets of numbers. Practically, however, it is useful to align the two concepts, to provide greater consistency especially regarding timing considerations. Whilst budgeting is an overall and annual concept within SAP, planning provides a more granular monthly view of planned expenditure. This is particularly useful in identifying delays in expenditure and triggering budget adjustments between years on a timely basis. Moreover, effective project controls are critical within the process of combining budgeting and planning a capital expenditure budget,

Engaging Procurement

The relevant period for capital expenditure budget control is the planned date of receipt of goods and services and not the date at which the purchase order is raised. It is useful to engage strategic procurement in the budgeting process to help validate this timing especially in request of long lead time purchases. Long lead times may arise in development projects or with purchase of overseas items requiring shipping. If the budget is not correctly distributed by year, it will not be possible to raise purchase orders with realistic delivery dates. A potential risk is that procurement officers will adjust the scheduling on an order to accommodate budgeting constraints. This leads to multiple negative downstream consequences including causing confusion amongst suppliers, distorting forecasting, and providing a misleading cashflow requirement.

Validated Forecasts

Forecasting is a key control to managing capital expenditure by period. Within SAP, planning is unconstrained. However, to improve the reliability of capital expenditure forecasts, they should be aligned with existing budget, actual and commitment values. For example, forecasting expenditure lower than open commitments would not normally be logical. Similarly, forecasting in excess of budget should trigger an exception alert.

Actual Cashflow

In addition to reporting the expected timing of expenditure to be incurred, organizations do rely on the actual cashflow projections on major capital projects for optimizing their financing arrangements. When reporting is done in SAP, it is possible to reference supplier payment terms and down-payment requests to calculate anticipated actual cashflows.

Software for a Fully Integrated Capital Expenditure Budget

The annual capital expenditure budget in SAP applies to the year in which costs are incurred. Whilst commitments may be raised in a prior year, and suppliers may only be paid in a subsequent year, it is the timing of the receipt of goods and services that is effectively controlled by the annual budget. Capex process participants including project managers, finance, procurement, accounts payable, asset and tax accountants may all have slightly different perspectives on the timing of capital projects, and it is essential to align expectations of all parties accordingly.

SAP provides deep functionality for the management of budgets, forecasts, commitments, actuals, payments, work-in-progress, depreciation charges and cashflow. The IQX Capital Expenditure Requests solution makes it easier to leverage these inherent capabilities by providing intuitive user-interfaces to enhance the validation of data-entry, workflow automation to engage all relevant stakeholders efficiently and flexible integration to orchestrate transactional updates for consistency and productivity.

Related Posts

If you enjoyed reading this, then please explore our other articles below: