In this article

In this article

More than 70% of organizations* that run SAP bemoan the inefficiency of their capital expenditure (capex) planning, budgeting, and approval processes. Despite running the world’s leading Enterprise Resource Planning (ERP) software, more than 85% of customers recently surveyed still rely on Excel spreadsheets. Why and is there a better solution for capital planning?

Steps in the Capex Process

What is the capital expenditure (capex) management process, and why do we use spreadsheets so much?

Ideas and Investment Proposals

The capital project planning cycle is continuous. Plant and equipment need replacement. New technologies should be adopted. Threats and opportunities emerge. Urgent investments may need exceptional approval. The normal cycle, however, is to accumulate these wish list items and submit them for inclusion in next year’s capital budget. For many organizations, each department submits a spreadsheet of their capital budget requests.

Project Selection and Budgeting

The capital controller consolidates these budget requests balances demand across areas and project types, within resource and financial capacity constraints. Invariably, capital investment ‘demand’ exceeds capacity, and decisions must be made as to what goes into the capital budget. The common approach is to rank projects and select the projects that matter most. Again, the most common tool used to support this project portfolio management is a spreadsheet.

Business Case Preparation and Approval

Once the annual capital budget is approved, many organizations require formal business cases to be prepared and approved before projects are initiated and expenditure committed. The format for these business cases is often another spreadsheet.

Project Procurement and Asset Accounting

Project procurement and accounting activities are typically handled within an organization’s ERP system. But even here, spreadsheets are often involved as part of the project completion process to collect asset details and valuation splits.

Forecasting and Analytics

Effective tracking and monitoring of the progress of capital projects relies on a combination of budget, actual, commitment and forecast data. Frequently, capital expenditure forecasts are provided by project managers via spreadsheets. The capex controller often needs to extract actual and commitment data from SAP to combine with spreadsheet-based budget and forecast data to present executive capex dashboards.

Current Challenges in Capital Planning

Spreadsheet-based CapEx management processes have been refined over decades. So why is there still a problem?

The CapEx process engages a broad range of participants. Everyone in the organization can have an idea, identify a risk, or spot an opportunity. Managers are responsible for achieving their unit’s performance objectives and need to prioritize investments within their area of responsibility. Senior executives optimize enterprise capital resources, prioritizing high potential business units and strategic initiatives. Their focus is on the impact of the capital project portfolio on future operating results. Capital controllers enable the collaboration between these participants.

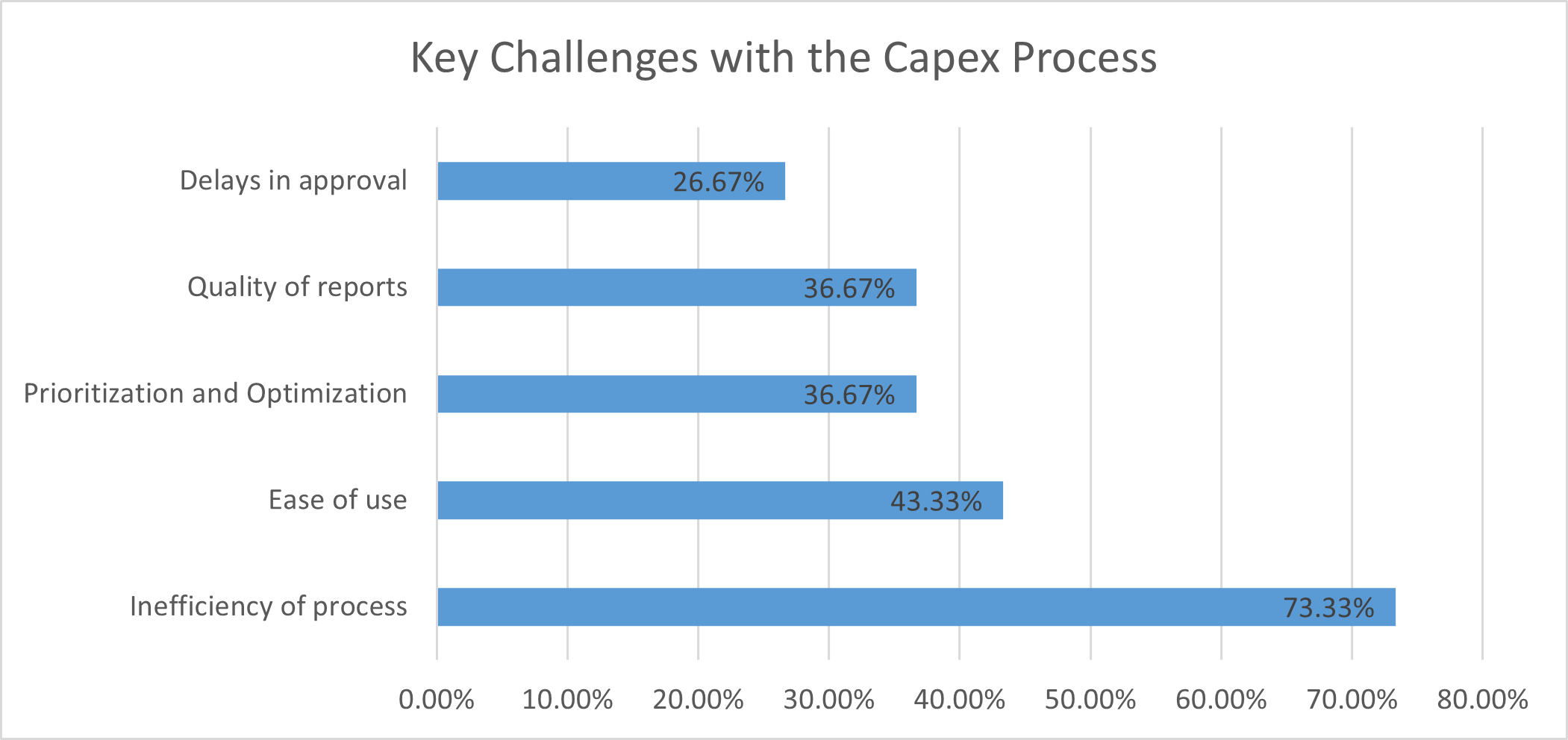

When polled, these participants point to a common

set of challenges and frustrations, as outlined below:

Inefficiency of Process

Nearly 75% of participants in the CapEx process rate inefficiency as a primary challenge and frustration. This inefficiency is inevitable with a spreadsheet-based process. Data has to be entered into the spreadsheets. And then data must be extracted and re-processed into downstream systems. The key virtue of spreadsheets, like Microsoft Excel, is their flexibility.

The downside is that Excel templates are easily modified and are thus not good candidates for automation. Invariably the spreadsheet distribution, collection and reprocessing involve significant manual effort.

Due to the sophistication and complexity of spreadsheet templates that have been refined over the years, this task is reliant on key personnel. Too often senior and highly paid resources spend more time in spreadsheet administration than value added support and analysis which is a patent productivity problem.

Ease of Use

Whilst spreadsheets typically start off simply, complexity is often continuously introduced to satisfy new and edge cases. If a project classification is required for one type of project, the column appears for all. If a formula is useful for certain investments, it’s applied to all. The sophistication of spreadsheet templates embellishes the spurious accuracy they betray. The effect on end-users is that nearly 50% of participants find their spreadsheet-based capital expenditure request forms and templates difficult to use.

Prioritization and Optimization

The key objective of the CapEx Management process is to invest wisely. To avoid the bad apples and enjoy the low-hanging fruit. Most organizations, however, continue to experience the pain of capital projects that have gone wrong. Projects that are overdue, over-budget and fail to deliver promised results. Equally common, executives fear and experience the dread of having missed out. New technologies, new markets and time-sensitive opportunities slip by. Spreadsheet based scoring and ranking models are failing to effectively maximize the return on investment of limited resources or mitigate the risk of failure.

Quality of Reports

Nearly 40% of CapEx process participants distrust the quality of presented information. Data is often too late to take effective mitigating action. Information is often not sufficiently accessible or detailed enough. There is limited traceability of changes to spreadsheet-based data or version control. Expenditure forecasts are not reliable, and long-term impact assessments are not produced. Executives, in particular, express grave concerns about the integrity of reporting and the underlying performance of the capital project portfolio. This is not surprising when the reporting basis is a cobbled together set of spreadsheets!

Delays in Approval

The primary association of many participants in the CapEx process is with the approval process. As capital expenditure decisions are high-value, high-impact, and complex, many levels of review, endorsement and approval are often required. The most common frustration of participants is the lack of transparency of the workflow status.

Knowing who to include, and then knowing who the bottlenecks are, and being able to follow-up accordingly. Workflow systems were necessarily improved during COVID to accommodate remote work. However, workflow solutions are often based on static spreadsheets with limited contextual or drill-down capabilities. There is limited opportunity to investigate or refine submissions in process which causes significant delays in getting final approvals due to the manual follow-ups and clarifications required.

Capital Budgeting Needs

What would an ideal solution look like?

Single Source of Truth

The main problem with spreadsheet-based process is the lack of a single source of truth. By contrast, a single source of truth would help ensure completeness, accuracy, and validity of source data. A single source of data enables more timely and reliable analytics. A single source is easier to secure, and to provide appropriate access as required.

Ease of Use and Collaboration

An effective CapEx budgeting solution is accessed by a broad range of individuals. Many of these users are infrequent, and it should be easy to both initiate and collaborate on initiatives. Executives should be able to easily understand the benefits, costs, and risks of every initiative, as well as the degree of alignment to their strategic imperatives in order to make more confident and timely decisions.

Agile and Effective

In today’s dynamic environment, an annual capital planning cycle is too slow. With rapidly evolving technologies and environmental uncertainties ranging from supply chain constraints to interest rate volatility, organizations need the ability to respond more quickly to threats and opportunities. The metrics used to evaluate different types of projects need to be more nuanced to effectively optimize project portfolios. For example, sustenance projects, growth projects and environmental projects will focus respectively on risk, return, and emissions reduction.

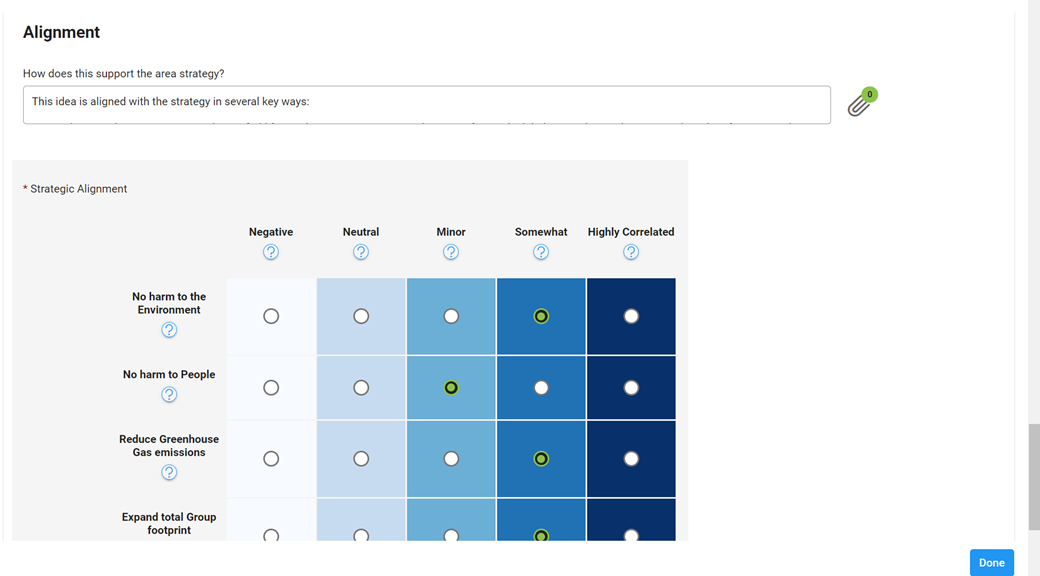

Strategic Alignment

A key area where reliance on spreadsheet templates impacts portfolio effectiveness is being able to measure strategic alignment. By their nature, strategic priorities will vary as an organization matures and in response to operating conditions. Static spreadsheet templates often do not reflect these strategic drivers in the facilitation or evaluation of new ideas. By contrast, a more effective capex management process will provide visibility of the strategic framework and ensure that investment initiatives are aligned to achieve these strategic goals soonest, at least at cost and lowest risk.

Solution Alternatives

If not spreadsheets, then what?

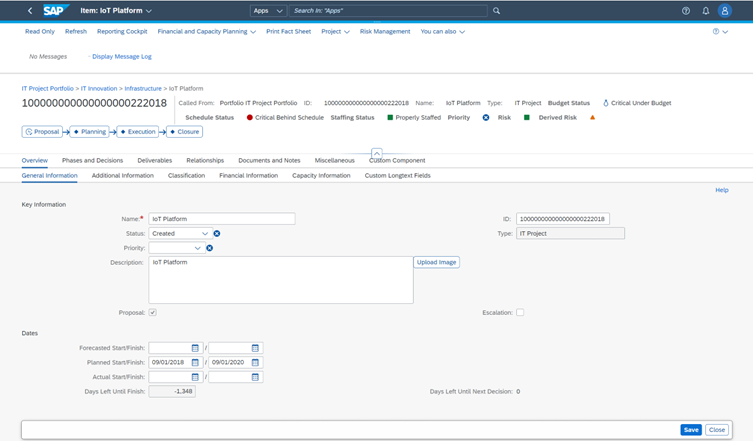

ERP Module Extensions such as SAP EPPM

Most enterprise resource planning systems have a project portfolio planning and budgeting extension. SAP customers can take advantage of SAP’s Enterprise Portfolio and Project Management (EPPM) module. SAP EPPM incorporates SAP Project Systems (PS), SAP Portfolio & Project Management (PPM), SAP Commercial Project Management (CPM), Enterprise Project Connection, and SAP Innovation Management.

Many organizations have not adopted SAP EPPM due to cost and complexity. Rolling-out SAP-licenses to all CapEx process participants from plant engineers to executive managers can be cost prohibitive. In addition, implementation of these solutions can be highly reliant on specialist consultants and take months to configure and deploy. The solution can also be perceived as too complex for their needs: too much of a sledgehammer when a tool with greater subtlety is required.

SAP EPPM is most viable once an organization is on S/4HANA and can take advantage of SAP’s more user-friendly Fiori environment. Unfortunately, many SAP teams are too pre-occupied with planning, migrating, or stabilizing their S/4HANA implementations to contemplate taking on additional SAP functionality scope.

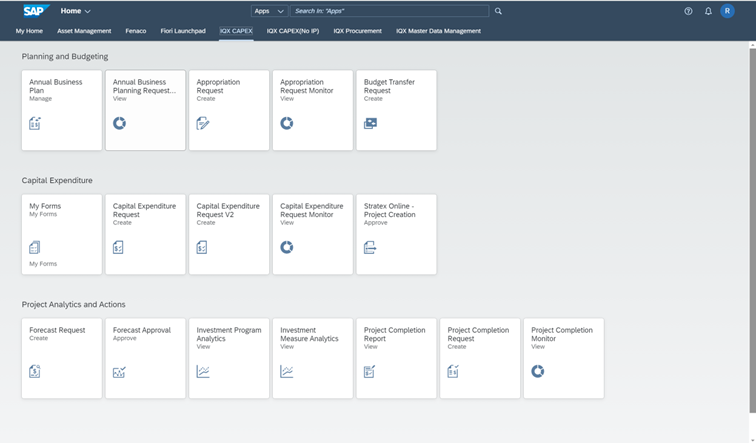

Leverage Capital Planning with SAP Fiori

SAP, like many ERP systems, has the core functionality to create and plan projects. What is really missing is the tailored user experience and workflow routing to leverage this core functionality more effectively and efficiently. Some organizations are therefore pursuing a path to replace spreadsheet-based CapEx planning processes with workflow-enabled SAP Fiori apps. Organizations can opt to build their own solutions or adopt configurable baseline solutions like IQX CAPEX to establish their capital plan.

SaaS Alternatives

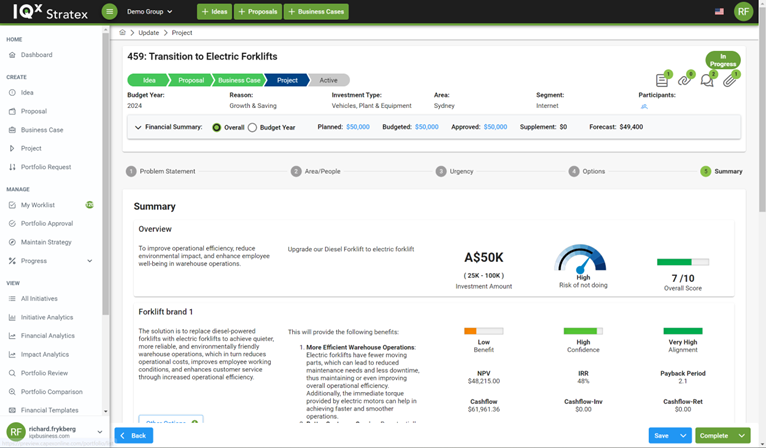

There are three key options beyond your current ERP system: Generic platforms (SharePoint, ServiceNow), Project Management extensions (Primavera, MS Project Online) or specialist capital planning and budgeting solutions such as Stratex Online.

The key benefits of a specialist capital planning and budgeting solution such as Stratex Online is that it is ready-to-run and pre-integrated with SAP. Stratex Online is self-configurable and highly flexible to accommodate unique classification, scoring and workflow requirements.

SAP Analytics Cloud

Financial Planning and Analytics (FP&A) personnel sometimes promote SAP Analytics Cloud as a CapEx Management solution. SAP’s Analytics Cloud is an important component of all solutions for the presentation and analysis of planning, forecast and actual data. Although SAP Analytics Cloud does not replace the transactional flows supporting ideation, budgeting, business case preparation and approval or project completion and asset capitalization.

Watch this SAUG webinar for more indepth detail on this article content.

Business Value of Digital Transformation

Improve Productivity Through Automation

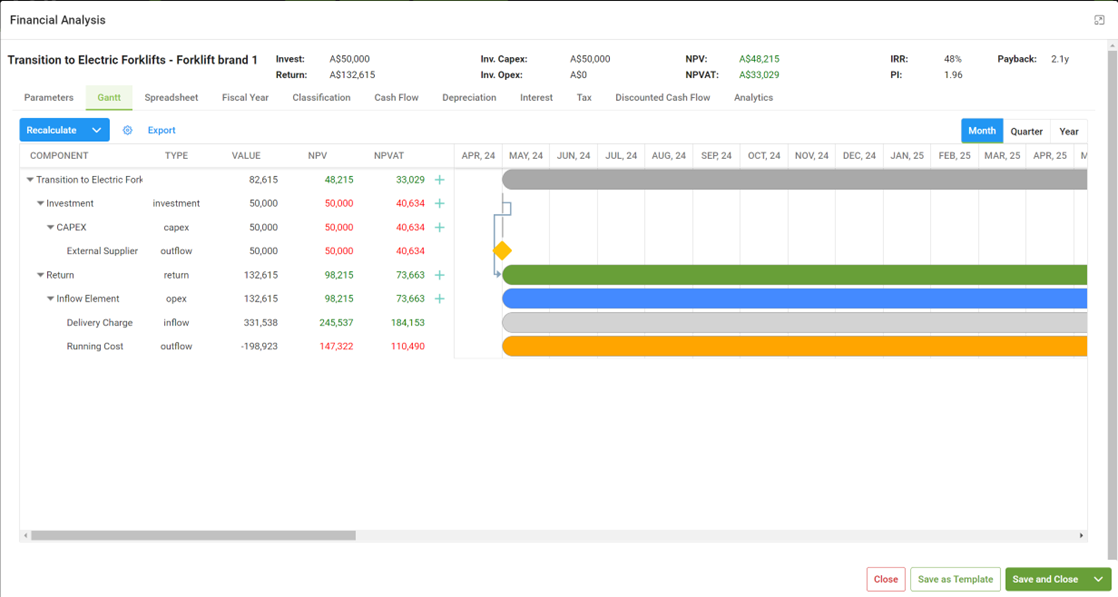

A key benefit of a systemized approach to CapEx Management is consistency of classifications and calculations. For example, with Stratex Online, key financial metrics such as NPV and Payback period are automatically and consistently calculated. By ensuring consistency of inputs such as exchange rates, discount rates and other global assumptions, initiators save time preparing business cases, and reviewers waste less time reviewing calculation formulae and assumptions.

Because of consistency in the classification and evaluation of initiatives, integration with external systems is facilitated. For example, Stratex Online automatically creates projects and internal orders in SAP.

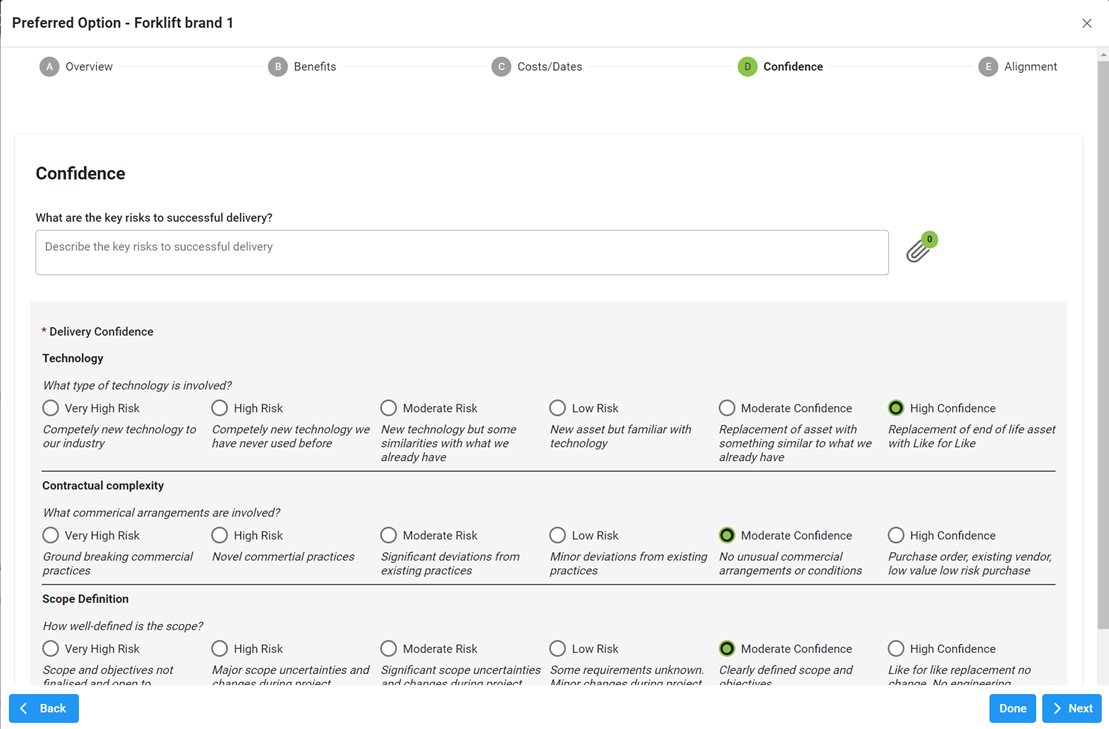

Avoid Wasted Expenditure with Delivery Risk Assessments

By conducting implementation risk assessments, managers can mitigate the risk of projects going over time and budget. Stratex Online offers a tool that not only assesses initiative benefits but also formally considers delivery confidence. By evaluating the risk versus return trade-off, finance managers can determine the efficient frontier of project portfolios and make informed capital planning decisions accordingly.

Prioritize Urgent Projects

Because organizations operate in an unpredictable environment, there is invariably a need for urgent, unbudgeted, capital expenditure. With a systematic solution, initiative urgency can be more objectively evaluated. For instance, defining risk matrix heatmaps in Stratex Online allows consistent evaluation of project urgency.

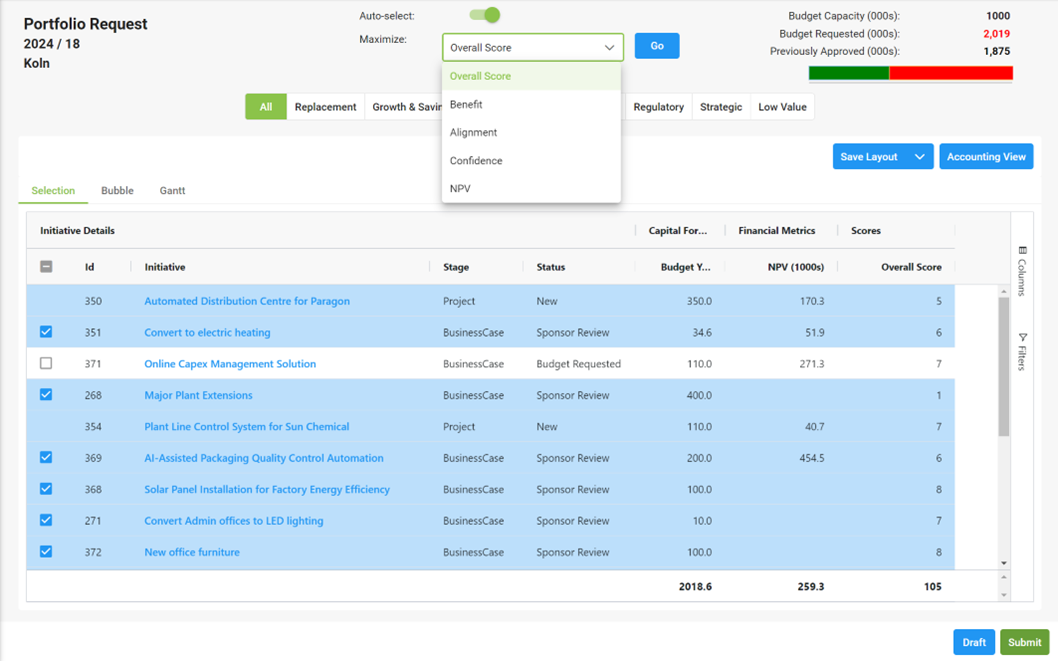

Optimize Portfolio Selection with Effective Scoring and Ranking

Portfolio selection is greatly facilitated with consistent and reliable prioritization metrics. Stratex Online is a solution that allows you to manually select project proposals based on multi-dimensional scoring. It can also automatically optimize your portfolio selection within your capital and resource constraints based on your project prioritization strategy.

Align your Investments with Strategic Objectives

Modern CapEx management solutions help ensure that projects are not only profitable, but also that they are strategically aligned. Stratex Online allows managers at each level of the organizational hierarchy define their strategic priorities and weights. Each initiative proposed can then be assessed regarding its degree of strategic alignment; enabling strategic capital planning.

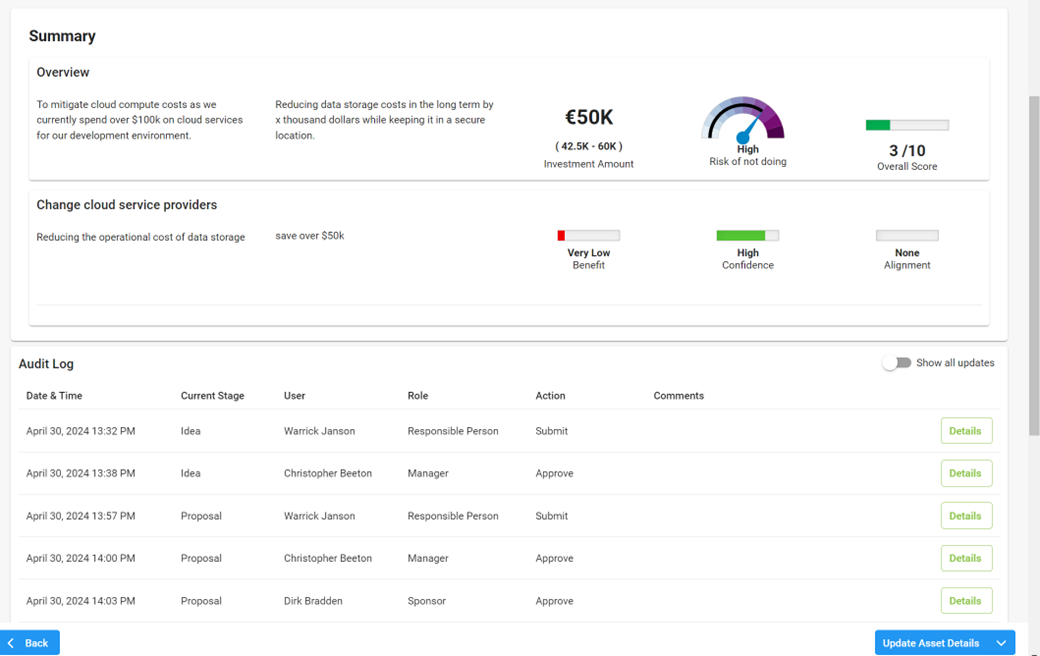

Comply with Governance Policies

With workflow automation and detailed audit trails, executives can be confident that delegation of authority approval polices have been effectively applied. In Stratex Online, the approval logic is specified through an approval matrix. The requirement for approval by a particular role is determined with reference to value, and other optional attributes such as budget status (e.g. unbudgeted), asset type (e.g. IT software), and investment reason (e.g. cost saving).

Control Capital Projects with high quality analytics

The main benefit of a single source of truth over diverse spreadsheets is the availability and quality of analytics. Participants can directly access the performance status of projects within their area of responsibility, avoiding the delays of data extraction, consolidation, and sharing via spreadsheets. With Stratex Online, area managers can easily analyze both the cost and impact of approved initiatives.

Capital Planning and Budgeting Solutions that Overcome Spreadsheets

Spreadsheet have been the best way of managing the CapEx process from idea to asset for decades. However, to remain competitive, managers need higher quality information to make better business decisions.

Consider leveraging more of your current ERP solution to meet the expectations of participants of a solution that is easier to us and delivers better results. If you run SAP S/4HANA, consider SAP Enterprise Portfolio and Project Management (EPPM). However, if this is too costly or complex for your requirements, specialist Capital Planning and Budgeting solutions such as Stratex Online may give you a more pragmatic way forward.

Next year, delight your stakeholders, and join the 15% who have found a better capital planning solution.

*Per a recent survey of over 50 customers attending an SAP User Group webinar on 12 May 2024.

Related Posts

If you enjoyed reading this, then please explore our other articles below: